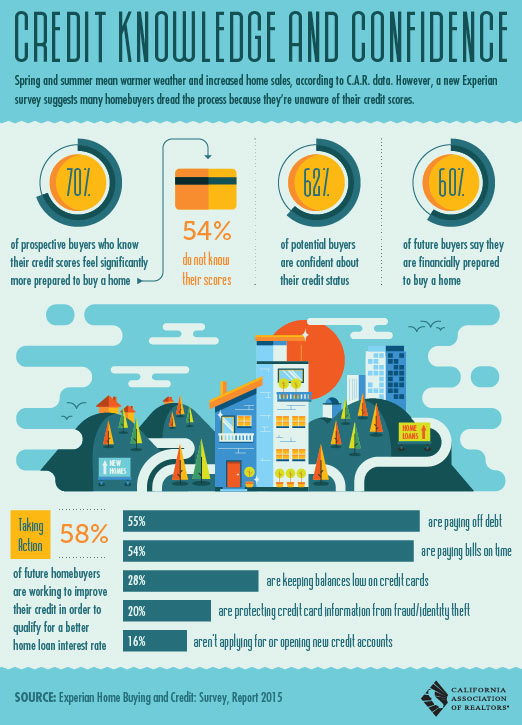

Spring and summer is such a busy time in the Lake Tahoe Real Estate industry as we have discussed in previous blogs. Not only do we see a lot of new Lake Tahoe homes for sale pop on the market, but that seems to be when a lot of the buyers come out and start looking at properties and making offers. If you have been looking for a home to buy in Lake Tahoe, take a look at this interesting chart courtesy of the California Association of Realtors. It displays the statistics behind buyer confidence and how it relates to their credit knowledge and finances. One of the things a qualified Tahoe Keys Realtor will tell you before buying a home is that getting pre-qualified is crucial to a successful buying process. By going in ahead of time, you are able to get a better grasp not only on what you qualify for based on credit and finances, but also if you can’t qualify and why. This allows you to fix any errors as well as save and get a good grasp on your finances so that you can take action to buy your dream home in Lake Tahoe. As you will see on the graph, 58% of buyers are taking the necessary steps to get a higher score so that they can obtain a better interest rate. These steps include keeping lower balances on credit cards, paying off debt and paying off bills on time. Per the graph, 70% of buyers looking to buy a home for sale in Tahoe Keys feel way more prepared to buy a home. Shockingly, 54% of buyers don’t even know their credit score. With the Lake Tahoe real estate market getting busier, it is so important for sellers to have a peace of mind when picking an offer. A lot of the time, they are going to pick an offer where the buyer knows their credit score, is prepared and has already been approved for the loan. If you are thinking of buying a home for sale in the Tahoe Keys and have questions on the process, call Peter Delilli at 530-308-4331.

Spring and summer is such a busy time in the Lake Tahoe Real Estate industry as we have discussed in previous blogs. Not only do we see a lot of new Lake Tahoe homes for sale pop on the market, but that seems to be when a lot of the buyers come out and start looking at properties and making offers. If you have been looking for a home to buy in Lake Tahoe, take a look at this interesting chart courtesy of the California Association of Realtors. It displays the statistics behind buyer confidence and how it relates to their credit knowledge and finances. One of the things a qualified Tahoe Keys Realtor will tell you before buying a home is that getting pre-qualified is crucial to a successful buying process. By going in ahead of time, you are able to get a better grasp not only on what you qualify for based on credit and finances, but also if you can’t qualify and why. This allows you to fix any errors as well as save and get a good grasp on your finances so that you can take action to buy your dream home in Lake Tahoe. As you will see on the graph, 58% of buyers are taking the necessary steps to get a higher score so that they can obtain a better interest rate. These steps include keeping lower balances on credit cards, paying off debt and paying off bills on time. Per the graph, 70% of buyers looking to buy a home for sale in Tahoe Keys feel way more prepared to buy a home. Shockingly, 54% of buyers don’t even know their credit score. With the Lake Tahoe real estate market getting busier, it is so important for sellers to have a peace of mind when picking an offer. A lot of the time, they are going to pick an offer where the buyer knows their credit score, is prepared and has already been approved for the loan. If you are thinking of buying a home for sale in the Tahoe Keys and have questions on the process, call Peter Delilli at 530-308-4331.

Leave a Reply